OpenAI, the company behind the recent groundbreaking breakthroughs of ChatGPT and Dall-E, is in talks about selling shares as part of a takeover bid. The Wall Street Journal reports that the company is valued at approximately 29 billion US dollars. This incredible valuation demonstrates the potential value of OpenAI’s work in artificial intelligence (AI) and machine learning (ML). Let’s take a closer look at these breakthroughs and why they are so valuable.

OpenAI recently unveiled its latest project, ChatGPT, which is a natural language understanding system that can generate human-like conversations. Unlike other chatbots which rely on pre-programmed responses, ChatGPT uses AI to generate responses based on what it understands from the conversation. This enables it to answer questions in more natural language and continue conversations for longer periods of time than ever before.

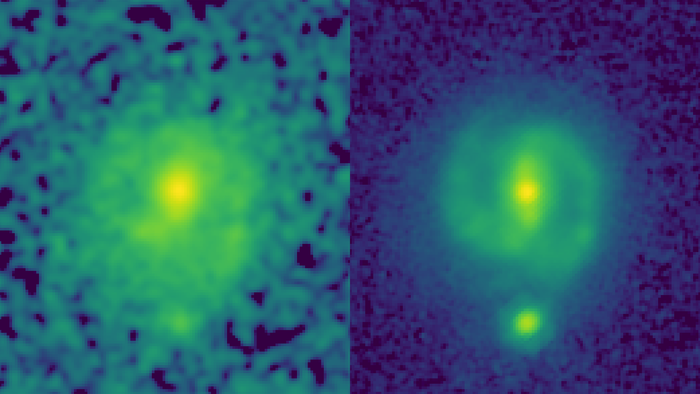

Dall-E: Another big success for OpenAI has been its image generator, Dall-E. This AI tool is able to take text descriptions and turn them into photorealistic images. For example, if you type “a giraffe riding a unicycle with a hat” into Dall-E, it will generate an image from scratch that accurately depicts your description. This shows the incredible potential of AI when combined with ML technologies like deep learning and computer vision algorithms.

OpenAI’s advancements in AI have led to its astronomical valuation of 29 billion US dollars. Their projects like ChatGPT and Dall-E have demonstrated the power of using ML technologies to create powerful tools for generating conversations or images from text descriptions. The possibilities are endless when it comes to what can be done with AI technology, and OpenAI is at the forefront of this exciting new field of research. It will be interesting to see where their next breakthrough takes us!