Once labeled as the world’s most valuable resource, fossil fuels have finally lost their spark. When John D. Rockefeller was forced to dissolve Standard Oil in 1911, it was clear there was a lot of money to be made in this industry. But today, there’s a new monopoly in town that’s replacing fossil fuels as the world’s most valuable resources, and it comes in the form of technology.

There are currently five tech companies that have the monopoly in this industry. They are Alphabet (Google’s parent company), Microsoft, Facebook, Apple, and Amazon. These five companies are the most valuable in the world and the first quarter of 2017 alone; collectively these companies earned more than $25 billion in net profit. Facebook and Google were responsible for almost all digital advertising revenue growth in the US in 2016 while Amazon takes nearly half of everything Americans spend online.

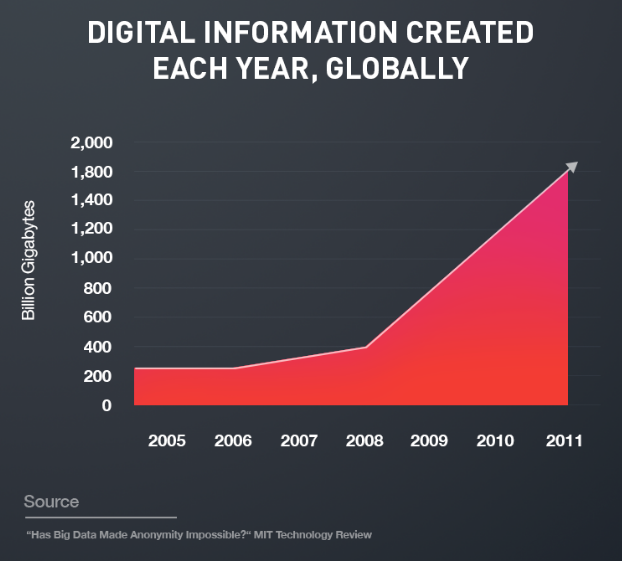

With the rise of the data, the economy comes a change in what we’re used to. No longer is there a limit to how much we can extract of the most valuable commodity. With data, it’s dynamic and allows far more opportunities for businesses to make use of. Facebook, for example, allows users to tag their friends in photos they share, enabling AI to make use of facial recognition technology.

The main area of confusion that comes with large amounts of data processing is in determining who owns the data. Luckily, there are laws in place to protect us consumers from our information being abused. But, these were created in the times of Rockefeller oil days and needed tightening as more control is needed to cope with the rise of the data economy. With the amount of data now in existence and the fact that it’s being added to all the time, has changed the way competition in the marketplace works.

Smaller rivals don’t stand a chance when it comes to developing products to compete with the big boys. Even if a smaller company thinks it’s made a breakthrough, chances are the larger tech companies are already in the case producing it. So, how do we go about creating a new antitrust law that will be more effective in this current data climate?

According to The Economist, one thing we must ensure is that any law created must assess merger impact in data-conscious ways. It could do this by taking into consideration how much data the merged company will have access to. Secondly, tougher regulation needs to take place that will force companies to be more open about what data they’re using for their customers and for what reason as well as giving both customers and third parties easier access to that information. At this current moment in time, it seems the FCC and Congress and not interested in supporting this kind of amendment to antitrust laws, and may not be for quite some time.

Related Links;

- It’s Official. Fossil Fuels Are No Longer the World’s Most Valuable Resource

- The world’s most valuable resource is no longer oil, but data

- European Antitrust Enforcers Move on Holders of Big Data

More News to Read