The rapidly changing digital environment and the continuous adaptation of the AI technologies are seeing a sharp rise in the trend graphs. Every business is getting empowered by the artificial intelligence technology, and the banking sector is no exception. According to a survey, 60 percent of the millennials say that they prefer an app for making payments and more than 70 percent say that having a banking app is very important”. The digital banking is the choice of the majority now, and the number will only grow in the future. Adoption of artificial intelligence has made the banking customer oriented and smarter.

Let’s check out what is the usage of AI in financial as well as the banking sector-

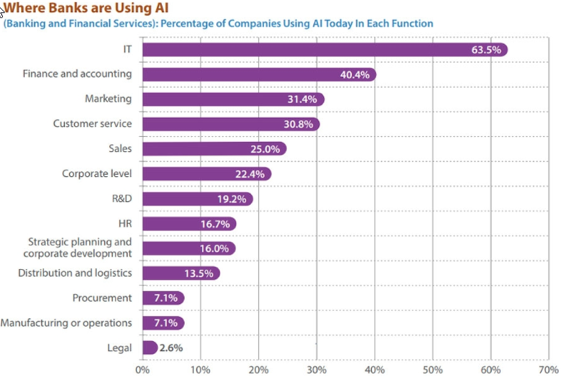

From the graph, we can see that banking and finance are not far behind from IT in using the AI/ML techniques.

Digital Journey of Users

The traditional process-oriented banking sector is evolving as a user-oriented technology hugging digital sector. The banking processes are transforming rapidly to stay ahead in competition by providing a holistic, and personalized banking experience to its consumers.

The revolution in the technologies has changed the face of the banking business. The banks have become fintech institutes where the business is driven by tech-savvy users and the innovation of smart devices. Digital payments like recharge, are the choices of today’s consumers.

According to a summit conducted by VISA, the rise of AI and IoT, which are empowered by the big data and analytics, will lead the digital payment explosion by 2022. This includes new methods of payment, that include nearly 400 million ways to get paid and over 30 Billion ways to make payments.

Use of the mobile and smart devices have increased the usage of smart payments. Payment methods like prepaid recharge, e recharge of mobile services, e-payments for entertainment, retail and every service possible, are now driving the banking sector. Users can make a fund transfer, raise a service request, interact with the banking officer or the RM, pay bills, set up the monthly billing cycle for recurring payments and many more with just a few clicks.

Technologies that are shaping the way of Banking augmented user experience

Artificial Intelligence has come to the point of maturity where it can be implemented into the real business and can be used to empower them. In the meanwhile, the banking sector has come to a saturation point with the traditional practices and has to offer something new to its consumers to provide them intuitive customer experience.

The main business factors that are driving the adoption of AI in banking are –

- A new generation of consumers who are exposed to systems like Siri or Amazon recommendations

- A sharp shift to the progressive banking arrangements and stiff competitions by new and challenger banks and other fintech institutions must lead the way to adopt the AI system by traditional banks

- The larger number of consumers and an infinite number of transactions which led to the emergence of technologies like Big Data and analytics. To keep up with the momentum of the need of scale of the banks have started to adopt the technologies like big data, speech recognition, image and text processing and more.

- The adoption of intelligent processes maximizes the profitability reducing manual efforts on mechanical tasks.

- AI techniques extract the value from the lame data resources which are the output of the big data technology in the banks

- Open Banking produces more valuable and meaningful customer data which bank can use to build better business models and intelligent services and apps through AI techniques.

- The predictive analytics of businesses contribute to the success of the banking services providing better business insights. It leads to better business decisions.

- Building smarter apps for smarter devices and access to cloud helps the banking sector building and maintaining intelligent apps.

Smart application of AI in Banking

- Machine Learning

Machine learning can be used in banking to make a fraud detection system. An intelligent algorithm will help in processing the payment transaction, identify the patterns from the data collected and will alarm in case of any anomalies or inconsistency in data.

- Deep Learning

Deep learning in banking can be used for finding new opportunities of business using the relevant customer information from social media or other platforms, to identify potential business opportunities

- Smart VAs and Bots

Smart VAs and Bots can be built by using the speech recognition and language processing systems. This will enhance and multiply the customer service experience.

- RPA

Robotic process automation is the application of ML to create a robot which performs high volume repetitive tasks to reduce the human intervention. The difference between automation and RPA is it learns continuously from human behavior and responds when the tasks are needed. The customer onboarding process, data entry, data validation and workflow acceleration can be done in banks through the implementation of RPA.

- Expert Systems

Now the AI systems have become matured enough to take decisions and provide business advice. Robotic systems and analytics can help wealth advisors to provide better advice to the consumers.

In conclusion, the coming years of banking and financial market and the whole industry will be influenced and impacted by the AI technologies which will further raise concerns about the aspects like data security, security threats, and banking frauds as well. However, after everything, it will open new directions and innovations to offer an unimaginable customer experience in the banks.

More News to Read

- Engineers Develop New System for Signaling Out Certain Sounds in Music Videos

- Scientists Develop New Technique to Study Antibiotic Resistance

- 5 Ways Artificial Intelligence Can Make the Construction and Engineering Sector More Efficient

- It’s Raining on the Self-Driving Car Parade

- Engineers Use Graphene to Create New Revolutionary Photodetector