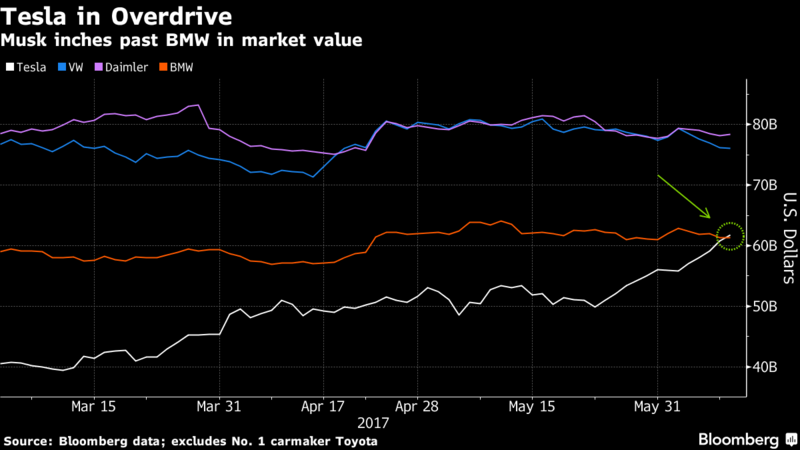

Early December last year BMW was valued at $30 billion. Up until now, BMW has always held a firm position in the market, but as of April this year, Tesla are now soaring past the German automakers. Tesla investors are confident the company came happily compete against another automaker that sells electric cars and still come out on top.

“The argument is that Tesla has the ability to do things that the others can’t and that, being all-in on electric cars, they will win,” said Kevin Tynan, auto analyst with Bloomberg Intelligence. “It’s a flawed argument. You can’t tell me that BMW can’t do what Tesla can do.” Tesla shares climbed a staggering 1.9 percent, surpassing BMW’s $61.3 billion market value as it went.

Musk also instilled more confidence in the company’s shareholders this week as he announced that the plans for the Model 3 were on schedule and production of the motors will begin next month. He would then like to see that followed up by a cheaper crossover model (Model Y).

However, Jim Chanos, an investor in Tesla, looks at things in a different light and expects Musk to burn billions in cash before making a real success of things. “We think they are going to be burning close to $750 million to $1 billion a quarter for the next handful of quarters,” Chanos commented at the recent Bloomberg Invest New York Summit. Tesla “has its big test ahead of it, the Model 3. It has been losing money selling $120,000 cars, but it hopes to make money selling the $35,000 car.”

But Tesla still isn’t anywhere near BMW when it comes to sales and profits. In terms of sales, BMW sold over 2.3 million motors in 2016. Tesla, on the other hand, sold less than 80,000. In terms of profits, BMW made around $7.7 billion in 2016, the same year Tesla lost around $725 million. However, the company is still connected to various other companies and that’s where some of the hype comes from. Most of Tesla’s share price is down to its battery business and self-driving car technology.

The stock price would plummet considerably if Tesla stopped trading on potential growth and began trading on profitability instead. In order for Tesla to get anywhere near BMW’s size, it would need billions in investment. The German carmaker spends around $59 billion in terms of plants, equipment, and property in order to make $104 billion in revenue. So, using the same scale, with Tesla using around $6 billion in plants and machinery, you would think they’d generate around $11 billion, but they actually generate closer to $7 billion in revenue.

That doesn’t stop Musk though and we will be seeing a lot more Tesla’s in showrooms across the country very soon. And, with the Model 3 soon to be available at a cheeky $35,000, we may be seeing quite a few more of them on the roads too!

More News to Read

- Testing Quantum Gravity with Merging Black Holes

- Starting a Company? Trust Your Instinct and Stop Listening People

- Radio Waves Might Help Protect Our World From Deadly Space Weather

- Can New Startup Grail Beat Cancer With its New Form of Testing?

- No Time For Visiting Art Galleries? Google Here to Help!!