So, we all know that Trump isn’t a believer in climate change, but thankfully, investors aren’t following suit. New research carried out by the Asset Owners Disclosure Project (AODP) revealed that 60% of the world’s 500 biggest Asset owners are now recognizing climate change as a problem and are investing in opportunities based upon a low carbon economy.

Various initiatives have been produced over the past few years that have highlighted the risks of climate change to investors, including the Principles of Responsible Investment, the Task Force on Climate-Related Disclosures and Science-based Targets, and CDP’s Carbon Disclosure questionnaire. It also helps that many of the companies where investors are placing their funds are already acting on climate change. This includes AB Inbev, Walmart, BMW, General Motors, and Apple, who all commit to using renewable sources to supply all their electricity.

With so many companies making the switch to renewable energy sources, the cost of renewable energy is coming down lower than ever before. The price of solar power alone fell a massive 83% from 2008 to 2016 with wind power prices following the same trend and dropping by around 73%. This trend has had an affect on the coal industry too. For the first time ever since the Industrial Revolution, the UK used no coal as a form of energy in April this year. In the US, even the Kentucky Coal Museum uses solar power in order to save money. Clean energy will be further boosted with thanks to the introduction of efficient energy storage systems whose cost are also coming down nicely. Lithium-ion batteries, for example, are now 73% cheaper than they were in 2010 and experts suggest they will be another 75% cheaper by 2030.

But, not everyone is jumping on board with clean energy initiatives. More than 60% of financial institutions in both Germany and the US show no intention of taking action against climate change. In Canada, Japan, and Switzerland less than 30% are ignoring the problems. Julian Poulter, the AODP CEO, said, “The Paris Agreement sent a clear message of global commitment to tackle climate change. Institutional investors are responding by rapidly scaling up action to tackle climate change risk and seize opportunities in financing the low carbon economy. This is recognized as a key issue by the Financial Stability Board and our Index enables asset owners and managers to report against the framework which will be recommended to the G20. It is shocking that many pension funds and insurers are still ignoring climate risk and gambling with the savings and financial security of millions of people. As the number of these laggards falls, their exposure to market repricing grows significantly higher and a time may be approaching when it’s too late to avoid portfolio losses.”

The report also demonstrated how there is a geographical split when it comes to tackling climate change, with Europe and Australia leading the way, and North America and Asia tailing behind miserably. There are no asset owners at all ignoring climate risk in the Netherlands, Scandinavia or Ireland. The UK is home to only 5% of laggers while France has just 3%. Over in the US, 115 asset owners are ignoring climate risk, which equates to a whopping 63%. And considering US asset managers make up around 27 of the top 50 in the world, trouble may be lurking ahead if they don’t change their action plans to consider climate risk. “Climate change is becoming a central part of risk management around the world, and will transcend short-term political setbacks such as moves by the Trump administration in the US to roll back action on climate change,” states Poulter. “Once investors adopt prudent risk management practices they will not unlearn them.”

More News to Read

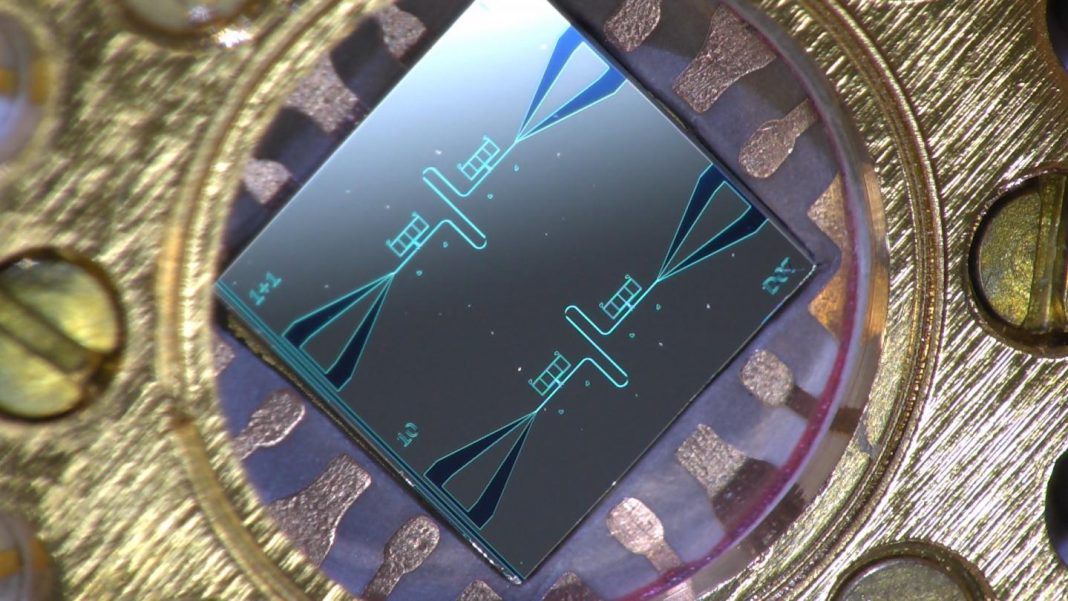

- Is the End of the Quantum Computer Race Finally in Sight?

- Excitement Stirs as the James Web Telescope is Almost Ready to Go

- Move over Spielberg and make Way for this Script Writing AI

- Scientists Uncover a Higher State of Consciousness

- Self-Taught Artificial Intelligent Increases Heart Attack Prediction Rate Significantly